Which type of overhead rates, plant wide, departmental or ABC are determined using a two stage cost allocation process? When are activity based overhead rates needed to provide accurate product costs? In the sections above, several comments were made in reference to the decision of whether to sell raw chicken or fried chicken. Following this decision rule, the joint costs arenot relevant because they will not be different regardless of the decision to sell at the split-off point or to process the products beyond this point.

Cost Allocation in Shared Services

An allocation base for human resources could be the number of employees in each department. In conclusion, reciprocal costs are shared expenses incurred by multiple departments or activities within an organization, posing challenges for accurate cost allocation. One of the primary challenges in cost allocation for shared services is determining the appropriate basis for distribution.

Impact of Technology on Allocation Methods

2) Solve the system of equations for the service departments [1] simultaneously. Although simple problems with two or three unknowns in each equation can be solved by hand,computer programs are required to solve the equations in realistic situations. The three methods for stage 1 allocations are illustrated in the example provided below. Moreover, technology enables more sophisticated analysis and visualization of cost data. Advanced analytics and business intelligence tools can uncover hidden cost drivers and inefficiencies, providing actionable insights for management.

How Liam Passed His CPA Exams by Tweaking His Study Process

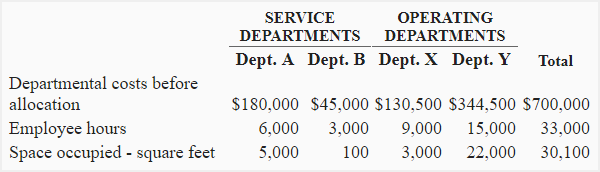

If a firm produces many different products that consumeindirect resources in different proportions, then a two stage approach is needed to provide accurate product costs. The General Products Company is a manufacturing firm with six service departments and five producing departments. Many of the service departments serve each other in addition to providing service to the producing departments. The various departments and applicable variable direct cost, (i.e., the cost identified with these departments before reciprocal service cost allocations) are presented in Table 1 for the most recent accounting period.

Moreover, ABC is particularly valuable in environments where overhead costs constitute a large portion of total costs. Traditional costing methods might allocate these overheads uniformly across products, leading to distorted cost information. In contrast, ABC ensures that overheads are allocated based on actual resource usage, providing a more accurate picture of product costs. This accuracy is crucial for pricing decisions, product mix optimization, and profitability analysis. For example, a company might discover through ABC that a seemingly profitable product is actually a loss-maker once all relevant overheads are accurately allocated.

The objective of this approach is to create equal gross profit percentages for all joint products. The average, or overall profit margin is the relevant measurement for the decision to produce or discontinue the joint process, i.e., produce allor none. However, critics of this method argue that since all joint products are not equally profitable, the joint cost allocation method should not imply thatthey are5. A counter argument is that all joint cost allocations arearbitrary in that the true profitability of individual products is indeterminable.

From the performance evaluation and behavioral perspectives, the amount of fixed service cost allocated to a user is more meaningful if it is not influenced by variations inthe short term consumption levels of other users. The dual rate method simply provides a way to implement this idea which reduces the inevitable behavioralconflicts created by the cost allocation process. Another advantage of the dual rate method is that spending variances for both fixed and variable costs can becalculated when the actual service costs differ from budgeted costs. A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments. This problem is eliminated by using the single budgeted rate method illustrated below.

- The Virginia Chicken Company combines a poultry business with a chain of restaurants that specialize in southern fried chicken.

- The plant wide rates provide inaccurate product costs because the products do not consume the indirect resources in the same proportions in each of the two departments.

- Whether either of these taxallocation schemes is also “fair and equitable” is subjective and therefore controversial.

The Reciprocal Method is the most accurate and comprehensive of the service department cost allocation methods, but it’s also the most complex. The basic premise is to account for the interaction between service departments and not simply ignore the services they provide to each other. To simplify the illustration, we will use the direct method for service cost allocations and ignore maintenance costs. Budgeted power cost allocations based on the dual rateconcept are presented in Exhibit 6-10.

Discuss the different conceptual bases for allocating costs to cost objects.3. Describe three general methods of assigning costs to products including one stage and two stage approaches.4. Discuss the circumstances under which turbotax discount 2021 each of the methods referred to in learning objective 3 will provide accurate product costs.5. Describe the direct, step-down and reciprocal methods of allocating service department costs to producing departments.6.

Can joint costs be allocated to joint products based on a “cause and effect” relationship? To illustrate the advantages of the dual rate or flexible budget method, consider the revised information that appears in Exhibit 6-9. This exhibit shows the same data thatappears in Exhibit 6-3 except service costs are separated into fixed and variable elements. From the perspective of the matching concept, (i.e., matching cost and benefits) it is logical to allocate a cost to the object (e.g., user, activity, department, product) basedon a “cause and effect” relationship.