Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data. These rules make it easier to examine financial data by standardizing the terms and methods that accountants must use. The reason is simple — accrual accounting helps large corporations stay compliant, maintain transparency, and keep a true view of their financial performance.

What are Accruals?

Accrual accounting uses double-entry accounting, where there are generally two accounts used when entering a transaction. This method is more accurate than cash basis accounting because it tracks the movement of capital through a company and helps it prepare its financial statements. In transactions between businesses, it is common for payment not to be made on the same date that an order is made or that goods are transferred. Cash accounting, on the other hand, records income and expenses when you receive or deliver payment for goods and services. Expenses, on the other hand, must be recorded in the accounting period in which they are incurred. Therefore, accrued expense must be recognized in the accounting period in which it occurs rather than in the following period in which it will be paid.

Recording Accruals on the Income Statement and Balance Sheet

Accruals are important because they help to ensure that a company’s financial statements accurately reflect its actual financial condition. This method allows the current and future cash inflows or outflows to be combined to give a more accurate picture of a company’s current and long-term finances. Under the accrual method, the $5,000 is recorded as revenue as of the day the sale was made, though you may receive the money a few days, weeks, or even months later. If you sell $5,000 worth of machinery, under the cash method, that amount is not recorded in the books until the customer hands you the money or you receive the check. For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method.

Is accrual accounting good or bad?

For example, let’s say that a clothing retailer rents out a storefront for $2,500 per month, paying each month’s rent on the first day of the following month. This means that the landlord doesn’t receive payment until after services have been provided. Using the accrual accounting method, the landlord would set up an accrued revenue receivable account (an asset) for the $2,500 to show that they have provided services but haven’t yet received payment.

- Accrual accounting is encouraged by International Financial Reporting Standards(IFRS) and Generally Accepted Accounting Principles (GAAP).

- This means that revenue is recognized when payment is received, and expenses are recorded when they are paid.

- Accrual accounting is an accounting practice in which revenue and expenses are recognized when they are earned or incurred, regardless of when cash is exchanged.

- For small businesses or sole proprietorships with straightforward financial activities, cash basis accounting can be simpler and easier to manage.

Has your business reached the point where you’re ready to hire more employees or expand into new customer markets? As your business becomes more complex, it may be time to revisit whether accrual accounting will be more effective for your financial and tax reporting. Notice that in case “B”, John has paid $80,000 cash but has recorded a $100,000 expense during the period because the annual rent of the building is $100,000, not $80,000. The remaining $20,000 is a current liability, known as rent payable, which will be settled in a subsequent period. Also notice that in case “C” John has paid $150,000 cash but has again recorded only $100,000 as rent expense.

When Were Accounting Principles First Set Forth?

The accrual concept of accounting requires that accounting records, including journal, ledger, and income statement, reflect transactions at the time when they actually occur, not necessarily when cash changes hands. This basis of accounting is generally used by companies for preparing their financial statements, except the cash flow statement. Expense recognition is a pivotal element of accrual accounting, ensuring that costs are recorded in the period they are incurred, aligning how to make a billing invoice with the revenues they help generate. This principle, known as the matching principle, provides a clearer picture of a company’s profitability by linking expenses directly to the revenue they produce. Another example of an expense accrual involves employee bonuses that were earned in 2023 but won’t be paid until 2024. The 2023 financial statements must reflect the bonus expenses earned by employees in 2023 as well as the bonus liability the company plans to pay out.

The use of accrual accounts greatly improves the quality of information on financial statements. Unfortunately, cash transactions don’t give information about other important business activities such as revenue based on credit extended to customers or a company’s future liabilities. Accrual is the notion of recognising a cost or income that has been incurred or received but has not yet been shown in the company’s financial statements. Even though payments for some services have not yet been made in full, accruals in the company are important because they ensure that the financial statements of the company accurately represent its financial health. The most notable principles include the revenue recognition principle, matching principle, materiality principle, and consistency principle. Completeness is ensured by the materiality principle, as all material transactions should be accounted for in the financial statements.

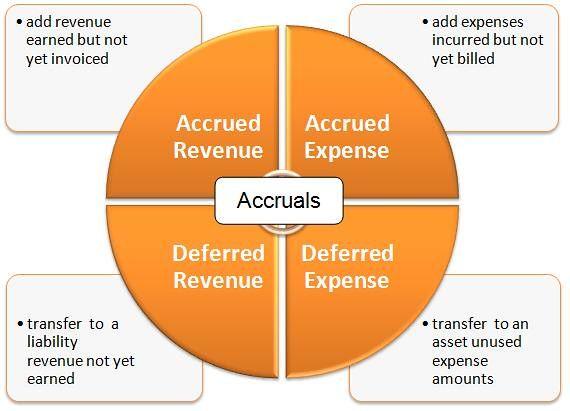

This happens when you receive a good or service, but the provider expects you to pay at a later date. For example, let’s say you received merchandise for your business in March and received an invoice of $500 with payment due in April. This is common when customers pay for a subscription or have recurring payments, like a phone bill. For example, let’s say a customer paid $100 for your consulting services in January, but you’ll only be providing the service in February. For example, if you provided a consulting service for $100 in January but you expect the customer to pay in February, you’ll have an accrued revenue of $100 in January. The accrual concept of accounting may be a little complex for some people, but it has many benefits.

An adjusting journal entry therefore records this accrual with a debit to an expense account and a credit to a liability account before issuing the 2023 financial statements. Cash basis accounting records revenue and expenses when actual payments are received or disbursed. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Likewise, expenses for goods and services are recorded before any cash is paid out for them.