Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Capital Expenditures are-treated as assets, and they do not form a part of the expenses.

Great! The Financial Professional Will Get Back To You Soon.

The accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly in the long term. The term “accrual” derives from the fact that expenses are recognized in an accounting period other than when they are paid—when they have accrued. The historical cost of assets and liabilities will still be updated over time to depict accounting transactions like depreciation or the fulfilment of part or all of a liability. But it will not be updated to reflect the current value of a similar asset or liability which might be acquired or taken on. Equally, preparers should not be ‘overly prudent’ to the extent that they pick the lowest possible outcome simply to avoid the risk of overstating assets and income or understating liabilities and expenses. This would still not provide a fair presentation of the financial position or financial performance of the entity and, therefore, it is important that caution is exercised to avoid this as well.

- Lenders and investors like to see how your business is performing beyond just what’s in the bank, and accrual-based statements show exactly that.

- We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

- Accounting information is not absolute or concrete, and standards are developed to minimize the negative effects of inconsistent data.

- According to the accounting equivalence concept, when sales of goods or services are made, assets are likely to go up, either by way of cash or accounts receivables.

Accrual Principle of Accounting: Definition

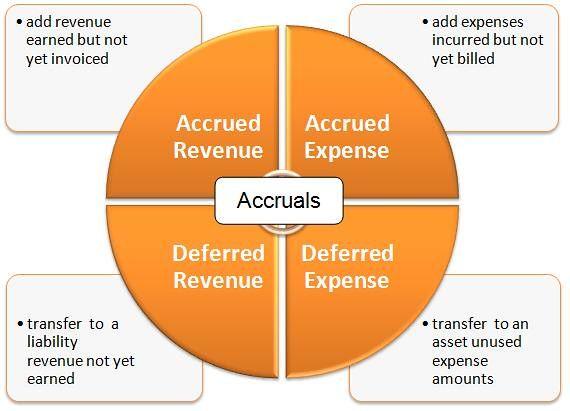

The interest expense recorded in an adjusting journal entry will be the amount that’s accrued as of the financial statement date. The concept of accrual is the recording of expenses or revenue that has been incurred or earned but still has not been recorded in the financial statements of the business. Accruals in the business can include different transactions, such as expenses incurred but not yet paid or unpaid invoices for any services provided.

Streamline your accounting and save time

However, under the accrual method, the $1,700 is recorded as an expense the day the company receives the bill. Although the definition might seem a little complicated at first reading, this is essentially a simple idea. This makes it easier for investors to analyze and extract useful information from the company’s financial statements, including trend data over a period of time.

Accrual Concept Journal Entry

This will result in overstating assets (because more has been earned) and understating liabilities/stockholders’ equity (since less is owed). Businesses could also be using “off-balance-sheet financing” techniques which means not including certain operating leases as part of current assets/liabilities. They owe $50 to an employee who worked through the month of December (accrued expense). In addition to the purchase of these goods, the business also incurs certain other expenses that are not specifically related to these goods, such as telephone expenses. The accrual principle is often confused with—or treated as only an aspect of—the matching principle.

These accounts are often seen in the cases of long-term projects, milestones, and loans. Accrual basis accounting recognizes revenue when the service is provided for the customer even though cash isn’t yet in the bank yet. A profit is noted as soon as a client places an order, and an expense is recorded when a bill arrives or a service is rendered. Accrual accounting can be contrasted with cash accounting, which recognizes transactions only when there is an exchange of cash. Additionally, cash basis and accrual differ in the way and time transactions are entered. If the company receives an electric bill for $1,700, under the cash method, the amount is not recorded until the company actually pays the bill.

Accruals impact a company’s bottom line even though cash has not yet changed hands. This is accomplished by adjusting journal entries at the end of the accounting period. A company with a bond will accrue interest expense on its monthly financial statements even though interest on bonds is typically paid semi-annually.

This method arose from the increasing complexity of business transactions and a desire for more accurate financial information. Selling on credit and projects that provide revenue streams over a long period affect a company’s cash flow-to-debt ratio: definition formula and example financial condition at the time of a transaction. Therefore, it makes sense that such events should also be reflected in the financial statements during the same reporting period that these transactions occur.

Depending on the size and complexity of your company, you may need to hire a professional accountant. If your company needs to purchase raw lumber for $3,000 to build more furniture, you would record the $3,000 as an expense immediately, even if you aren’t able to pay until next week or next month. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

However, the FASB and the IASB continue to work together to issue similar regulations on certain topics as accounting issues arise. All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. HBS Online’s CORe and CLIMB programs require the completion of a brief application.