For instance, direct allocation can be used for easily traceable costs like departmental supplies, while step-down allocation might be applied to more interconnected services such as facilities management. Reciprocal allocation can address the intricate interdependencies of departments that frequently exchange services, ensuring a comprehensive reflection of resource usage. Which stage I cost allocation methods consider reciprocal services?

Deciphering Reciprocal Costs: A Beginner’s Guide to Cost Allocation

Although this is the simplest method, it is also the least accurate method. The step-down allocation method, also known as sequential allocation, is more sophisticated than direct allocation. It involves allocating costs from service departments to production departments in a sequential manner.

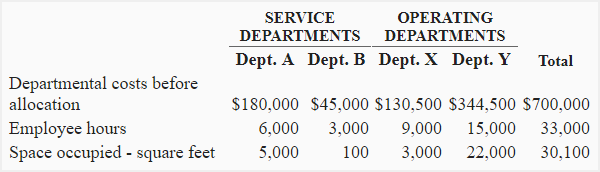

1: Allocation of Service Department Costs

- In addition, these allocations have some rather senseless implications from the decision perspective, e.g., the company would be moreprofitable if it produced chickens with only breasts and wings.

- Regularly scheduled meetings and detailed reports can help departments understand their cost responsibilities and the rationale behind them.

- Technology plays a pivotal role in facilitating effective cost allocation in shared services.

- The denominator for the proportions of service provided from S1 to P1 and P2 is 900, not 950 and the denominator for the proportions of service provided fromS2 to P1 and P2 is 250 not 300.

- 1) The point of allocating service department costs to operating (product departments) is to recognize the full costs of the operating departments.

- Budgeted power cost allocations based on the dual rateconcept are presented in Exhibit 6-10.

Determine the difference in the total operating cost if electricity were purchased externally and indicate whether the company should make or buy electricity. Now assume that the actual number of purchase orders completed during the period was 290 for the Cooking Department and 100 for the Canning Department. Also assume that actual costs for purchasing and receiving are $60,000 fixed costs and $39,000 variable costs. These entries reduce cost of goods sold by $75 which is the net amount received from the by-product sales. Now that you have the TOTAL Cost of Maintenanceand Personnel, it is time to allocate it using the Total Costamounts from Step 2 and the percents from Step 1. Now assume the Thurow Company produces two products as indicated below.

Managerial Accounting

The Cutright Company has a small factory with two service departments and two producing departments. The service departments, Power and Maintenance provide support to the producingdepartments, Cutting and Assembly, to each other and also use some of their own services. These estimates are used todevelop predetermined departmental overhead rates for the Cutting and Assembly departments.

Activity-Based Costing (ABC)

Other names for the reciprocal method are simultaneous solution method, cross allocation method, matrix allocation method and double distribution method. The situation would be different if one service department consumed a lot of a second service department, and that first service department primarily served a single operating department. Failure to allocate service department costs in a way that recognizes this consumption pattern between service departments, could distort a correct understanding of cost behaviour and lead to poor decision making. The advent of advanced technology has revolutionized cost allocation methods, offering unprecedented accuracy and efficiency. Modern software solutions, such as enterprise resource planning (ERP) systems and specialized cost management tools, have automated many aspects of the allocation process.

Management Accounting: Concepts, Techniques & Controversial Issues

Note 1 E’s costs are apportioned directly as no reciprocal service is involved. Note 2 It doesn’t really matter which of the two remaining cost centres you start with. Note 3 On the last reapportionment, D’s overheads are apportioned on the basis of 75/95 to A and 20/95 to B.

Describe the types of relationships between the departments within an organization. The following symbols are used to develop equations for each approach. Her diverse experience includes public, small business and government accounting, as well as logistics and inventory management. She holds an MBA from the University of Illinois at Springfield. Now that you have the TOTAL Cost of Maintenance and Personnel, it is time to allocate it using the Total Cost amounts from Step 2 and the percents from Step 1.

For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point. Since these parts ofthe chicken have relatively little value, they tend to fall into the category of by-products. Suppose the after split-off costs, such as collecting and packagingthe parts are estimated to be $25 for 2,000 pounds of feet, beaks and gizzards. If the company does not inventory theseby-products and uses the cost reduction method, the entries are as follows. The self services (the 50 KWH’s used by S1 and the 30 labor hours used by S2) are ignored along with the reciprocal services (the 100 KWH’s used by S2and the 20 labor hours used by S1) in developing the proportions. Thus, the denominator for developing the proportions for S1 is 800,not 950 and the denominator for developing the proportions for S2 is 250, not 300.

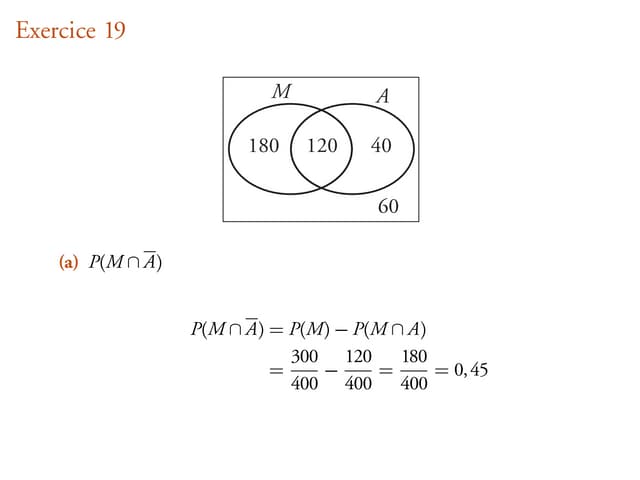

The reciprocal method is more accurate than the other two methods because it fully recognizes self services and reciprocal services between service departments. However, thismethod is more involved because it requires the solution to simultaneous equations. Although issues concerning the equitableness of various types of taxes are outside the scope of a cost accounting course, similar controversial issues arise with regard to costallocations within organizations. Generally, the allocation method should reflect the purpose of the allocation. For example, for the purposes related toproduct costing, (e.g., external reporting, planning and monitoring, pricing) costs are typically allocated (or traced) to products based on the “causeand effect” logic. Using the methods described in Chapter 3 (e.g., regression and correlation analysis) the system designer might attempt to definea relationship between the cost and the cost drivers objectively.

Navigating cost allocation in multi-department organizations requires a nuanced approach that balances fairness, transparency, and strategic alignment. These organizations often grapple with the complexity of distributing shared law firms and client trust accounts costs across diverse departments, each with unique functions and resource needs. A well-structured allocation system can illuminate the true cost of operations, fostering accountability and informed decision-making.